Hubei Ruiyuan Electronic Co.,Ltd.

LightCounting: Chinese Cloud Companies to Fuel 2025 Optical Module Growth

Release time:

2025-05-10

May 6 News - Recently, the optical communication market research firm LightCounting stated that the battle for dominance in artificial intelligence is intensifying, but trade wars are casting a shadow over the market outlook. Uncertainty about future trade policies could be sufficient to lower market expectations for 2025.

LightCounting reports that most projects, except the most urgent ones, will face delays this year. While this may present opportunities to seize the initiative in the AI race for companies and nations, no party remains unaffected by this uncertainty. Accelerating investment in 2025 will require exceptional courage and masterful supply chain management capabilities.

This year will mark a historic turning point for U.S. Cloud Companies - these enterprises have greatly benefited from global free trade in commodity services - with unprecedented growth.The new world order will differ significantly, with EU and US antitrust regulation posing another major challenge.Emerging national and regional cloud vendors will likely outpace their U.S. counterparts in growth.

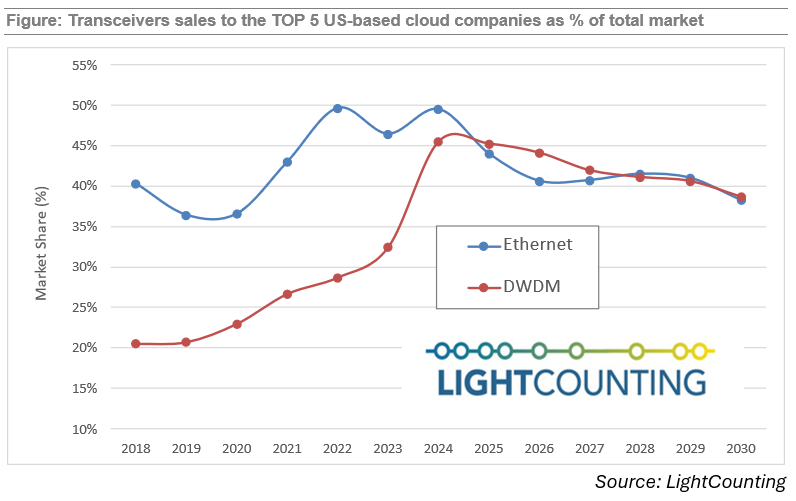

The figure below illustrates this trend by analyzing Ethernet and DWDM optical module procurement among the top five US cloud providers: Amazon, Google, Meta, Microsoft, and Oracle.Following ten years of stable expansion, their optical market share is set to shrink gradually. Despite ongoing spending increases on modules, growth rates will trail global peers.

Ethernet optical module sales grew by 90% in 2024, but LightCounting has revised its 2025 growth forecast downward from 40% (as projected before April 2) to 20% currently.The primary growth driver will stem from demand for Chinese cloud vendors, which will also boost active optical cable (AOC) sales in 2025.Chinese firms including Alibaba, ByteDance, and Huawei have doubled their 2024 optical component procurement budgets and are prepared to bypass US tariffs via alternative supply chains. Led by Huawei, these companies have actively pursued de-Americanization of technology over the past decade - efforts now poised to yield results.

Broad-based recovery in global telecom markets, coupled with steady investments in DCI networks, will drive the DWDM, FTTx, and wireless fronthaul optical module markets back to growth during 2025-2030.However, LightCounting has lowered its DWDM optical module sales forecast for the top five U.S. cloud vendors.

Global AI competition is accelerating digital transformation and cloud adoption across industries, including video AI model training and inference.Optical networks and the global telecom industry will become indispensable components of AI's future, unlocking new opportunities for carriers and their suppliers. Google's recent announcement of enterprise WAN services may trigger intensified competition.

Citation: China Electronic Components Association.

Retrieved from http://www.ic-ceca.org.cn

Online Message