Hubei Ruiyuan Electronic Co.,Ltd.

YOLE: Silicon Photonics Market Set to Surpass $2.7B in 2030

Release time:

2025-09-27

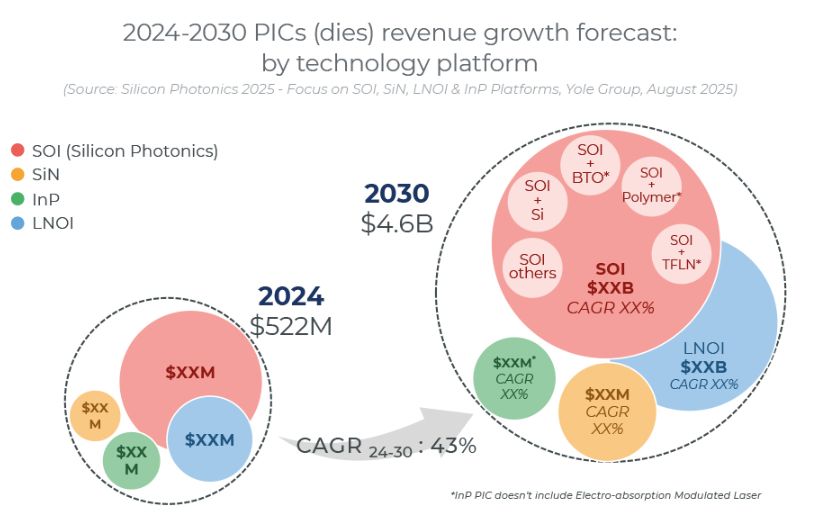

Recently, market research firm YOLE Group stated that silicon photonics technology is driving continuous breakthroughs in network bandwidth, enabling the scalable expansion of AI networks.Its market size is projected to surge from USD 278 million in 2024 to USD 2.7 billion by 2030, representing a compound annual growth rate (CAGR) of 46%.

In data centers (particularly for AI and machine learning), traditional processor architectures are approaching their physical limits, while the high-speed communication enabled by silicon photonics is critical for supporting faster computing.The growing demand for bandwidth is driving advancements not only in silicon photonics but also in thin-film lithium niobate technology, thereby enhancing network data transmission capabilities.

Photonic integrated circuits, particularly silicon-on-insulator (SOI) and lithium niobate-on-insulator (LNOI), provide a versatile platform for large-scale, scalable applications. Chinese companies are emerging as new leaders in this field, especially within data centers.Leveraging the stability of silicon material, the telecom sector has emerged as another major application scenario.

Furthermore, optical LiDAR, 3D integration, quantum computing, optical gyroscopes, and even medical photonics hold significant potential, although some applications still face technical and regulatory challenges.The extension of silicon photonics into the visible light spectrum is expected to enable more innovative applications in the future.

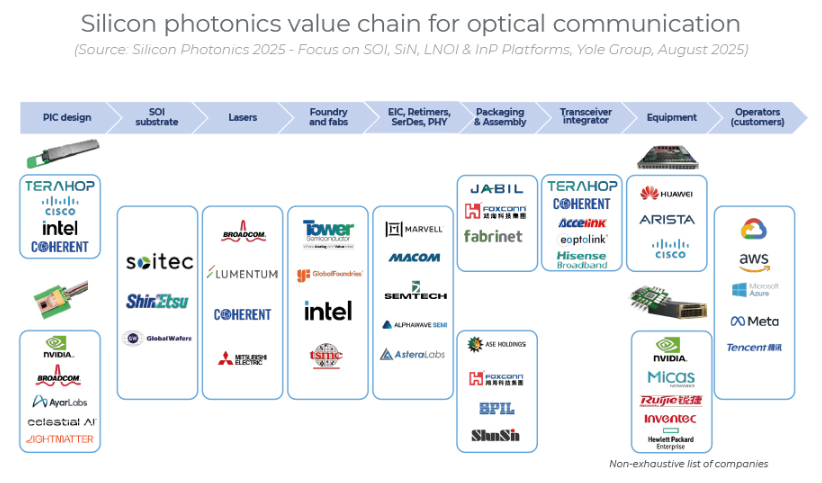

The industry remains optimistic about the value creation potential of silicon photonics, with its ecosystem evolving into a diversified landscape.Vertically integrated giants (e.g., InnoLight, Cisco, Marvell, Broadcom, Lumentum, Eoptolink) are actively expanding their presence.

Startups/design companies (e.g., Xphor, DustPhotonics, NewPhotonics, OpenLight, POET Technologies, Centera, AyarLabs, Lightmatter, Lightelligence, Nubis Communications) drive continuous innovation.

Research institutions (e.g., UC Santa Barbara, Columbia University, Stanford School of Engineering, MIT) provide critical technical support.

Foundries (e.g., Tower Semiconductor, GlobalFoundries, Intel, AMF, imec, TSMC, CompoundTek) ensure manufacturing capability.

Equipment suppliers (e.g., Applied Materials, ASML, Aixtron, ficonTEC, Mycronic Vanguard Automation, Shincron) complete the industry chain.

China has made significant strides in silicon photonics and is actively working to establish a global leadership position in the field.Chinese companies are focusing on independent innovation and enhancing mass production capabilities for high-speed optical communication products, accelerating the closure of the gap with Western peers and establishing China as a significant player in the field.

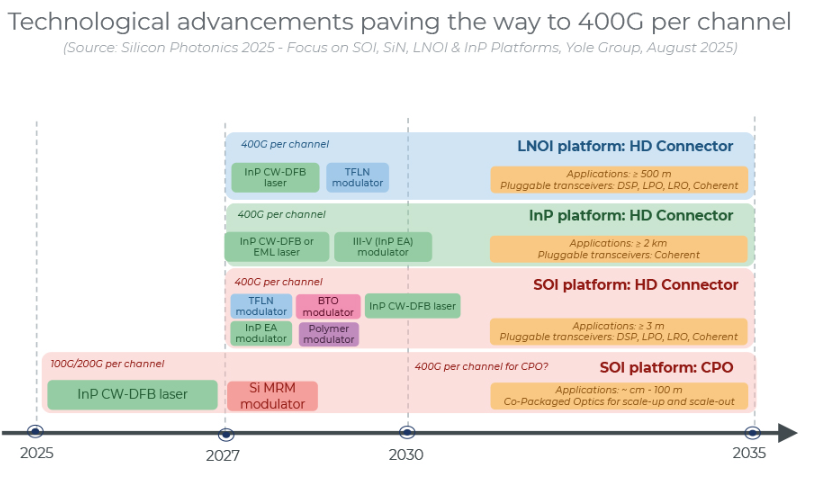

Notably, higher single-channel rates are pushing single-port Ethernet speeds to 3.2 Tbps (or beyond), while also enabling improved energy efficiency and a reduction in the number of lasers required.A reduced laser count lowers capital expenditure, simplifies the supply chain, and shrinks operational costs for thermal management and power supply.This trend creates opportunities for emerging technology platforms: leveraging inherent material properties, LNOI and indium phosphide (InP) are becoming superior choices for future high-speed connections.

The growing demand for scalable, energy-efficient, and cost-effective optical solutions in data center networks is fueling intense competition among platforms including SOI (featuring TFLN, BTO, and polymers), LNOI, and InP.Each platform possesses distinct advantages and challenges, collectively shaping the future of IM-DD or lightweight coherent pluggable modules and profoundly impacting the development of optical communication.

Citation: China Electronic Components Association.

Retrieved from http://www.ic-ceca.org.cn

Online Message